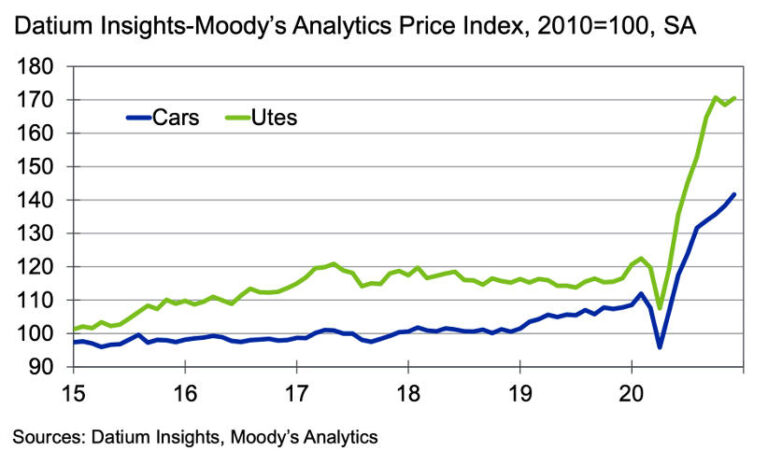

In 2020 Moody’s Analytics released the Used Car Index for the Australian market. In any other year it would have been an additional data source to confirm the information already collected in the market by a number of entities. Though in 2020 it provided sensational headlines as used car prices collapsed in April and then rebounded spectacularly ending the year 35% higher than December 2019.

According to Michael Brisson, who was the author of the latest report, “This incredible jump in prices is made more improbable because it happened as the nation endured numerous lockdown orders, devastating job losses, and the first recession in a generation.”

If you consider used cars as a retail sale, then the increase in prices was similar to what major retailers such as JB Hi-Fi and Harvey Norman experienced during 2020. The difference being how the market sets the price.

Traditional retailers saw a dramatic increase in demand for a range of products but the prices had already been set pre-COVID. While the prices for used cars vary based on a number of factors and market demand is a key driver. When the buyers are there, prices go up. When stock is tight, prices go up. When there is plenty of stock and no buyers, sellers take what they can to keep the sausage machine flowing.

Used cars experience seasonality every year and the period after Easter until October/November is normally when prices are depressed. There are also cycles during the decade which most Fleet Management Organisations have successfully rode for the benefit of their owners and shareholders. And 2020 was the year to make up any losses from earlier in the cycle.

The good news for retail buyers is that prices may have peaked at the end of 2020. Not so good for Fleet Managers that were hoping to capitalise on the strong prices in 2021.

According to the report, “Used-vehicle prices are expected to have peaked across Australia in the fourth quarter of 2020. As shown, wholesale prices are expected to decrease by a seasonally adjusted 3% in the first quarter of 2021 and an additional 1% in the second quarter. This will mark the first quarter-over-quarter drop in prices in the past two years outside of the lockdown-driven drop in the second quarter of 2020.”

Since 2010 there has been a slow and steady rise in used car prices until the start of 2020 when there was a sharp increase (as seen in the chart below). This was short lived because when the country entered lockdown in April, prices plunged; and rental car companies felt the double whammy of no customers and no buyers for the cars they didn’t need anymore.

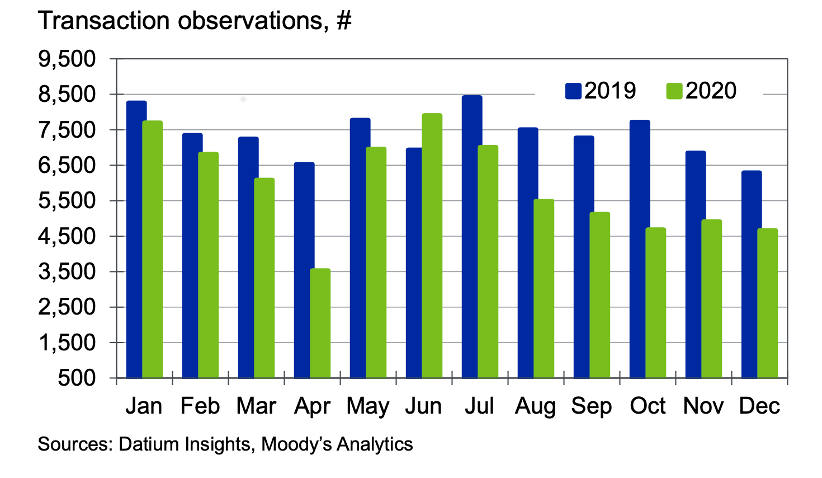

The report stated that transactions through Pickles, the largest auto auction house in Australia, ended the year down 20% compared with 2019 as shown in the chart below.

The reported causes for the lack of young used vehicle were fleets extending leases, a lack of new car stock and people turning away from public transport to stay safe from COVID.

Whatever the reasons, it was definitely a wild ride in 2020 so it’ll be interesting to see what happens in 2021.