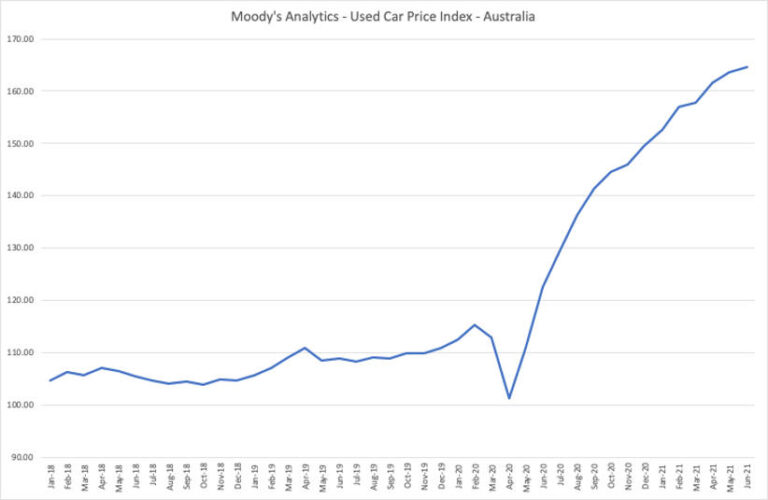

Used-vehicle prices across Australia have continued to rise throughout the second quarter of 2021. Monthly growth rates have slowed, but price levels have remained well above expectations because of a lack of vehicles on the market. According to the Datium Insights-Moody’s Analytics Used Vehicle Price Index, a hedonically derived index that controls for the mix of vehicles being sold, the cost of a used vehicle is 34% more expensive than at this time last year and 10% more expensive than at the start of the year.

The rise of used-vehicle prices over the last 13 months can be split into two distinct periods. During the first period, prices jumped back from the pandemic-induced losses of April 2020. During this period, monthly growth rates averaged over 5% for the next six months. The sharp growth in 2020 happened as people shifted away from public transportation and ride shares and gravitated toward private vehicle ownership. The shift in preference took place because of the perceived risks from COVID-19.

The second boost in price growth, after a slowing trend toward the end of 2020, is supply related. Used and new vehicles used to be somewhat separate markets, but not right now. New-vehicle supply is down worldwide and Australia is no exception. A shortage of electronic semiconductor chips has decreased the number of vehicles shipped into the country, driving up the price of any vehicle people are willing to let go of. This second rise appears to have slowed in June, but supply issues continue to put upward pressure on both new- and used-vehicle prices.

The supply constraint was further exacerbated by the record rate of new vehicle sales in Australia in April. Its seasonally adjusted annualised rate reached an all-time high in April at 1.3 million units. May also performed better than expected. Vehicle demand has remained strong as a result of the rapid economic recovery Australia was able to achieve coming out of the pandemic.

Despite used-vehicle prices continuing to rise, month-over-month growth rates reached their lowest level of the year in June.

The slowdown in growth has been especially evident in larger vehicles. Trucks/utes/SUVs are down 1% in the past quarter, compared with a 3% gain for passenger cars. The reason for the price divergence is two-pronged. First, fuel prices have risen, making larger vehicles comparably more expensive to drive. Second, ute prices had risen so fast in the second half of 2020 that they were approaching 100% of MSRP for some makes and models. This price ceiling put a cap on the gain that could be realised in the segment.

A good example of this is the Toyota Hilux. One of the most popular vehicles in Australia, the Hilux has remained in high demand throughout the recovery. At the same time, the supply of new vehicles remained low because of factory shutdowns in different parts of the world. A black 2019 Toyota Hilux, with 30,000 kilmetres driven, reached an expected price of 89% of MSRP in January. In January 2020, the 2018 Toyota Hilux, also with 30,000 kilometres driven, an almost perfectly comparable vehicle, was projected to be 80% of MSRP, according to the Moody’s Analytics AutoCycle residual value forecasting solution a difference of almost $4,000 for practically the same vehicle.

A return to normal depreciation patterns has already started. The end of used vehicles as an appreciating asset despite usage is upon us. It took a confluence of unpredictable circumstances—a highly transmissible virus, a surge in demand for consumer electronics, a fire at a major auto chip producer, and a rapid recovery in worldwide new vehicle sales—to flip the market on its head. It will not take that much for the market to return to normal.

It is expected that the worst of the semi-conductor shortage is behind us going into the second half of 2021. This is evidenced by a rise in U.S. auto production after steadily falling throughout the year. Still, a surge in available chips, and thus new vehicles, is not expected. Rather, a slow and steadily increasing stream of semi-conductors will begin to catch up with demand from manufacturers.

Prices will remain elevated for the remainder of 2021, compared with previous years, as the new vehicle market looks to stabilise. Still, there will be downward movement in the price levels as measured by the Datium Insights-Moody’s Analytics Price Index. However, the decrease in prices will not be as steep or dramatic as the rise in prices over the past year, keeping prices well above pre-pandemic levels. Risks to this forecast are weighted to the downside.

If there is a significant outbreak of the Delta variant of the coronavirus, countrywide mandated lockdowns could once again cripple economic activity. Job losses and recession would depress demand and cause used vehicles to sharply lose value. Nevertheless, the most likely path forward is a smooth and steady decline in prices over the short to medium term as the supply of vehicles returns and the market reaches equilibrium.