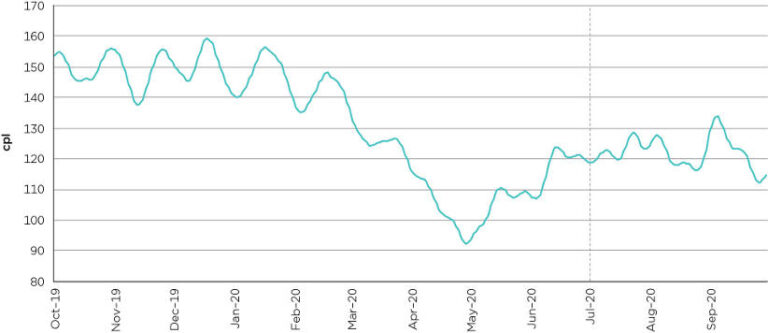

Average petrol prices rose in the September quarter 2020 after a record low earlier in the year, but still remain well below the 15-year real average of 151.6 cents per litre (cpl).

The ACCC’s latest petrol monitoring report shows the average retail price for petrol in the September quarter across Sydney, Melbourne, Brisbane, Adelaide and Perth was 122.1 cpl, an increase of 13.1 cpl from the June quarter 2020.

Average petrol prices (seven-day rolling average) in the five largest cities have been very volatile over the last 12 months, ranging from a high of 159.1 cpl in December 2019 to a low of 92.4 cpl in April 2020. However, prices were steadier during the September quarter 2020 and stayed mostly between 129.0 cpl and 118.0 cpl.

“We saw some major fluctuations during the first six months of the pandemic but petrol prices stabilised in the September quarter,” ACCC Chair Rod Sims said.

“Australia’s retail petrol prices are largely determined by international refined petrol prices, and between July and September we saw very steady international prices keeping our prices here within a narrower band.”

Petrol sales volumes partially recovered in the September quarter 2020, although the increase in sales volumes was not uniform across all states and territories.

In the month of September, petrol sales volumes across Australia were 19 per cent lower than monthly average sales in 2019, influenced by a 44 per cent drop in Victoria because of the state’s COVID-19 restrictions.

Darwin continues to have cheaper fuel

Darwin had the lowest average retail petrol prices of the eight capital cities in the September quarter 2020 at 118.0 cpl, which is 4.1 cpl lower than average prices across the five largest cities.

Darwin’s relatively low prices in recent years may have been influenced by the opening of new retail sites that are vigorous competitors, and the introduction of the Northern Territory Government’s fuel price transparency scheme, MyFuel NT.

“Increased competition between petrol retailers brings down prices, and fuel price data apps and websites empower consumers. Darwin motorists are currently enjoying the benefits of both these factors,” Mr Sims said.

“Motorists in New South Wales, Queensland, Western Australia, and now Tasmania, which introduced FuelCeck TAS in the September quarter, can also access real-time petrol prices through transparency schemes.”

Components of retail petrol price

September was the second successive quarter in which taxes (44 per cent) accounted for a larger proportion of the total price of petrol than the refined petrol itself (34 per cent).

Mogas 95, which is the benchmark for refined regular unleaded petrol in the Asia-Pacific region, and taxes together accounted for 78 per cent of the average price of petrol in the September quarter. These components are largely outside the control of petrol retailers.

“The increase in the average retail price of petrol in our five largest cities was driven mainly by an increase in the price of Mogas 95, but it must be noted that petrol retailers’ gross margins are at record highs,” Mr Sims said.

“Petrol retailing is a high-volume low-margin business with fixed costs, so we understand that some businesses have had to increase their margins to offset sales volumes that were 17 per cent lower in the September quarter compared to last year’s average.”

“As economic activity in Australia picks up again and sales volumes return to normal, the ACCC expects to see gross retail margins fall,” Mr Sims said.

Regional locations

In the September quarter 2020, average petrol prices in regional locations were lower than average prices in the five largest cities for the first time since the ACCC began quarterly reporting in 2015.

Average prices across the 190 regional locations the ACCC monitors were 120.0 cpl in the September quarter, 2.1 cpl lower than average prices in the five largest cities. In the previous June quarter, average regional prices were 7.5 cpl higher than average prices in the five largest cities.

“Petrol prices are slower to come down in regional locations but fortunately they are also slower to go back up, so drivers in regional locations on average paid less than their big city counterparts in the September quarter,” Mr Sims said.

Australia’s refining capacity

On 30 October 2020, BP announced that it would convert its Kwinana refinery in Western Australia to an import terminal because regional oversupply and sustained low refining margins had made it economically unviable.

In 2019, Kwinana was the largest refinery in Australia with a refining capacity of 8,830 million litres per year. This represented 32 per cent of total Australian refining capacity.

“As retail petrol prices in Australia are set according to international prices, and refineries in the Asia-pacific region are not operating to capacity, the conversion of Kwinana is unlikely to have an impact on petrol prices in Australia,” Mr Sims said.

Breakdown of the average petrol price in the quarter across the five largest cities