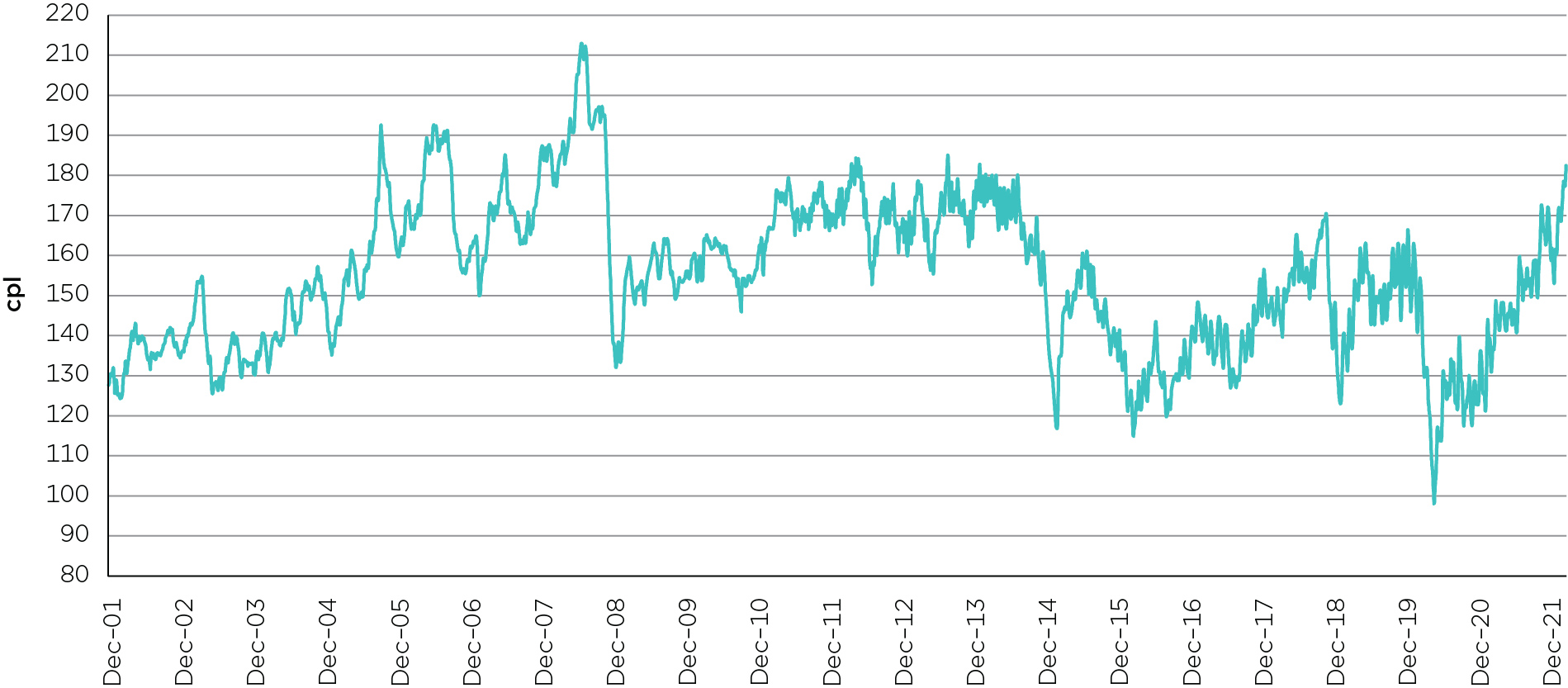

The ACCC’s latest petrol monitoring report reveals that daily average retail petrol prices in Sydney, Melbourne, Brisbane, Adelaide and Perth hit 182.4 cents per litre (cpl) in late-February 2022, which was the highest inflation-adjusted (real) level since 2014. Prices have risen further in the first two weeks of March.

The report looks at the December quarter 2021 but provides additional data and analysis up to the end of February 2022, as there have been large price increases so far this year.

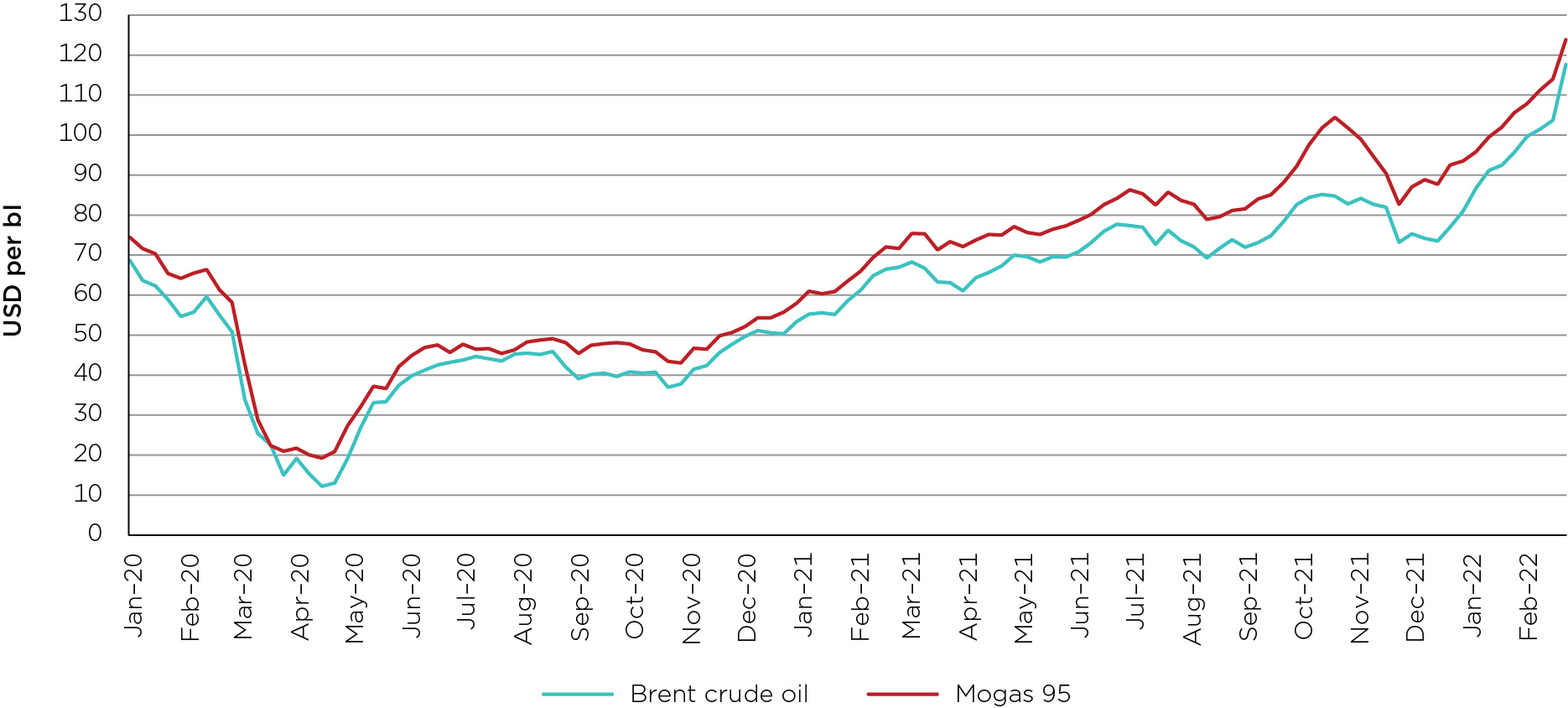

“The world was already experiencing high crude oil prices late last year due to the continuing actions of the OPEC and Russia cartel, and the enduring Northern Hemisphere energy crisis. The shocking events in Ukraine have forced crude oil prices even higher, as Russia is a major supplier of oil,” ACCC Chair Rod Sims said.

“Retail petrol prices in Australia are largely determined by international refined petrol prices and the Australian/US dollar exchange rate. As refined petrol is made from crude oil, movements in the global crude oil price drive the international price of refined petrol.”

“Crude oil prices have been climbing sharply since late-2020 and prices at the bowser here have followed,” Mr Sims said.

The last time prices in Australia were as high as they were in late-February was in January 2014, when strong international demand, conflicts in the Middle East and Ukraine, and a lower AUD/USD exchange rate pushed real daily average petrol prices to 182.7 cpl.

In June 2008, in the period before the Global Financial Crisis, daily average prices reached a record high equivalent to 212.9 cpl in today’s dollars.

December quarter 2021 prices

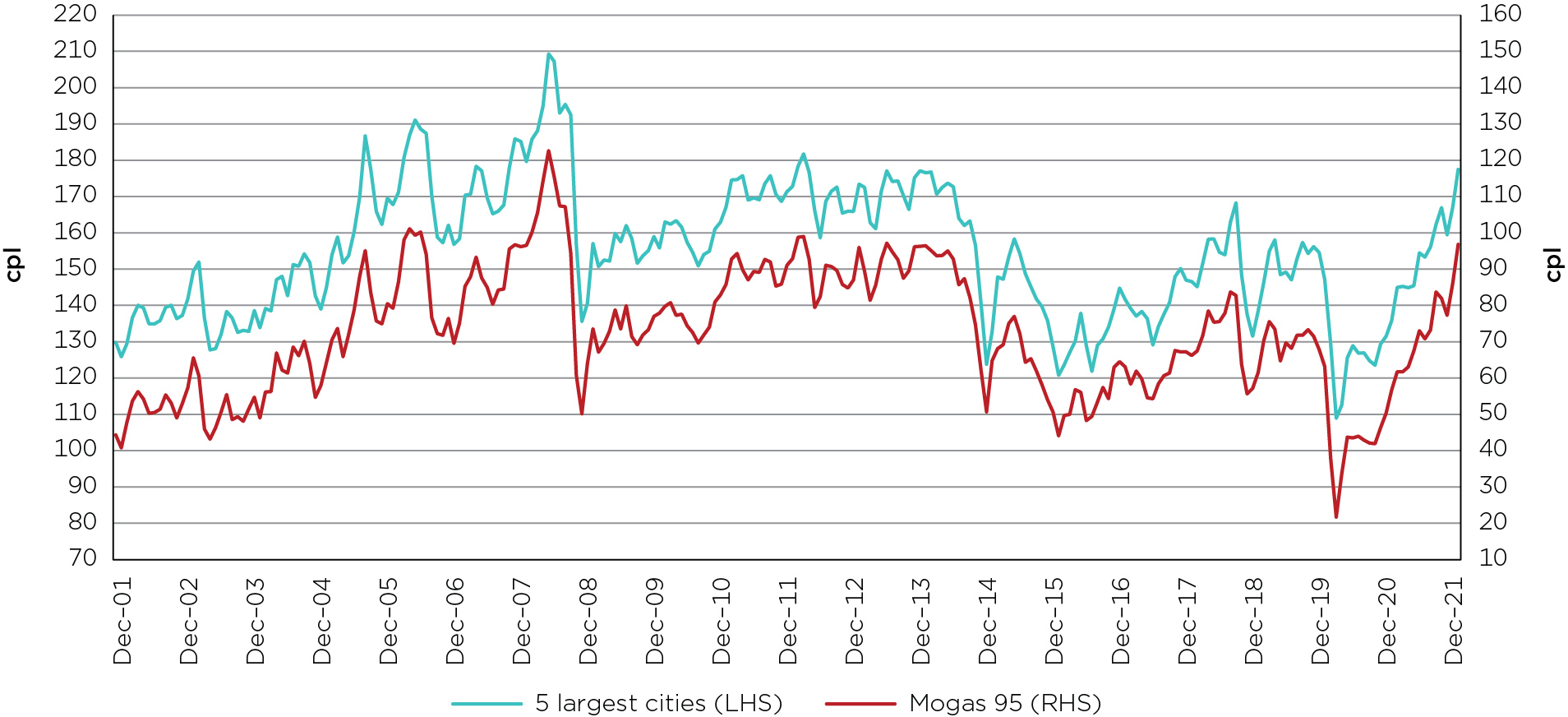

Quarterly average petrol prices in the five largest cities were 162.8 cpl in the December quarter 2021, an increase of 10.3 cpl from the September quarter 2021 (152.5 cpl).

In the 12 months between the December quarter 2020 and the December quarter 2021, average retail petrol prices increased by 41.4 cpl, or about 34 per cent.

Retail petrol price components

The three main components of the retail price of petrol are Mogas 95 (the benchmark price of refined petrol in the Asia-Pacific region), taxes (excise and GST), and other costs and margins at the wholesale and retail levels.

In the December quarter 2021, Mogas 95 and taxes together accounted for 86 per cent of the average price of petrol. The 10.3 cpl jump in average retail petrol prices in the five largest cities between the September and December quarters 2021 was mainly due to more expensive Mogas 95.

“It is tempting to point the finger at petrol retailers when prices are very high, but our data shows that late last year 86 cents of every dollar spent by consumers at the bowser was outside of the retailers’ control,” Mr Sims said.

“We’ll continue to closely monitor the movements in local retail prices to see if they reflect international prices.”

Adelaide prices lower than other capital cities

In the December quarter 2021, Adelaide had the lowest average retail prices of all the capital cities at 157.9 cpl. This was the third consecutive quarter in which Adelaide had the cheapest petrol.

The introduction of the South Australian fuel price transparency scheme in March last year appears to have had a positive impact on Adelaide prices. The average price increase to the peak of the city’s price cycle was 24.8 cpl in the nine months after the scheme commenced, compared with an average increase of 34.8 cpl in the nine months prior. At the end of 2021, however, the last three price cycle increases in Adelaide were each above 30 cpl.

“We strongly encourage motorists in all states to use one of the many available apps and websites that provide real-time fuel price information,” Mr Sims said.

“There can be large variation in price between different retailers and different suburbs, and 30 seconds of research before getting in your car can lead to significant savings.”

Retail sales increased after lockdown

There was a 21 per cent increase in the volume of petrol purchased from retail sites across Australia between the September and December quarters 2021. This was due to COVID-19 restrictions being eased in some states, particularly New South Wales and Victoria.

Petrol sales volumes in the December 2021 quarter were the highest since the March 2020 quarter, most of which was pre-pandemic.

Quarterly average sales volumes in Australia in 2021 were about 4 per cent higher than in 2020, and around 11 per cent lower than in 2019.

Weekly average Brent crude oil and Mogas 95 prices: January 2020 to early-March 2022

Source: ACCC calculations based on data from Argus Media.

Seven-day rolling average retail petrol prices in the 5 largest cities in real terms: 1 December 2001 to 28 February 2022

Source: ACCC calculations based on data from Informed Sources, FUELtrac and the Australian Bureau of Statistics.

Note: Real prices are adjusted for December quarter 2021 dollars

Monthly average retail petrol prices in the five largest cities and Mogas 95 prices in real terms: December 2001 to February 2022

Source: ACCC calculations based on data from Informed Sources, FUELtrac, Platts, OPIS, Argus Media, the Reserve Bank of Australia and the Australian Bureau of Statistics.

Note: Real prices are adjusted for December quarter 2021 dollars.