BY KATRINA ELL, MICHAEL BRISSON AND CATARINA NORO (MOODY’S ANALYTICS)

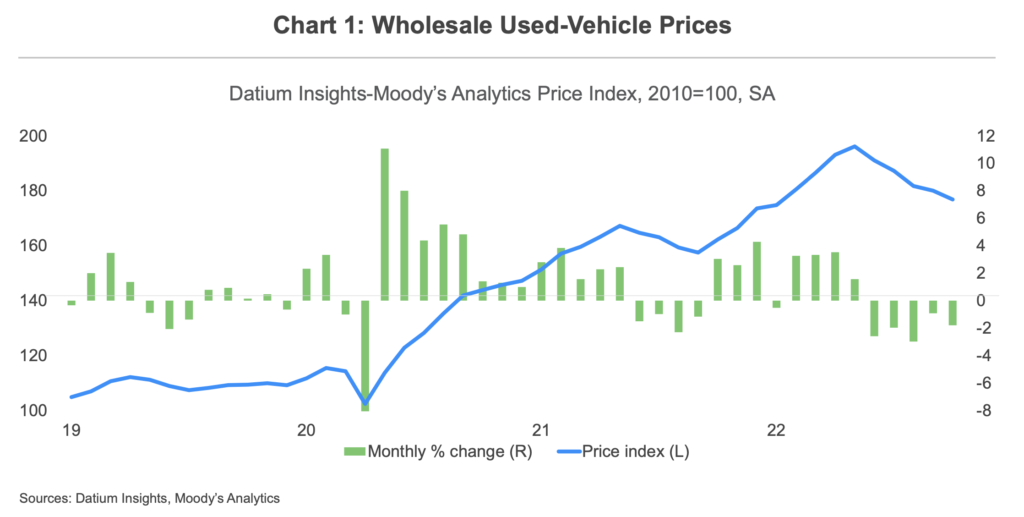

Australian wholesale used-vehicle prices continued their retreat through October. The Datium Insights-Moody’s Analytics Used-Vehicle Price Index peaked in May and has been falling since. It dropped to 176.8 in October from 180 in September (see Chart 1). Improved supplies of new vehicles have driven the retreat in used-vehicle prices.

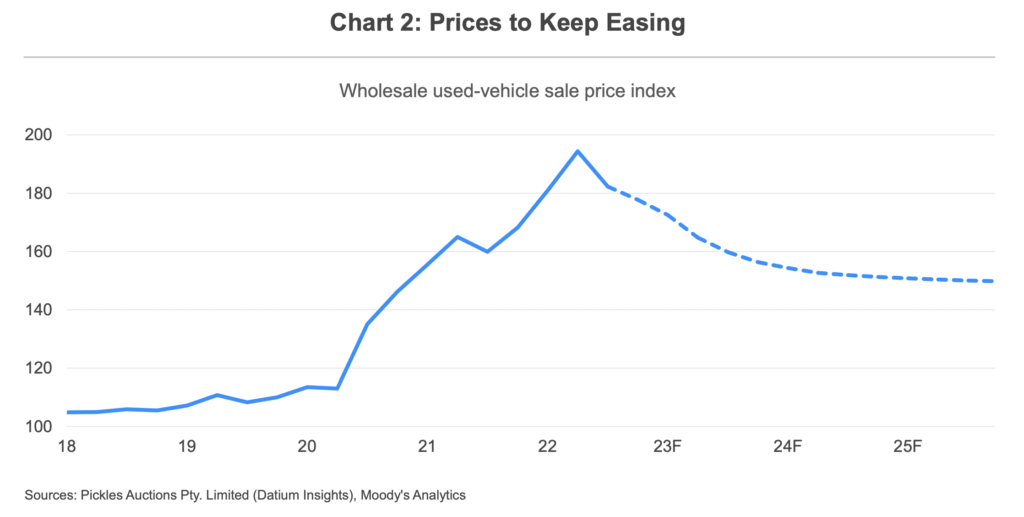

Moody’s Analytics expects used-vehicle prices to keep falling through 2023 as the supply of new vehicles into Australia improves (see Chart 2). In addition, weaker domestic demand will cool vehicle purchases as the combination of rising borrowing costs and elevated inflation erodes the ability of households and businesses to make big-ticket purchases.

Used-vehicle prices continued to retreat in October, marking the fifth consecutive month-to-month decline. Nevertheless, prices are still 8.6% higher than last year and 60% higher than pre-pandemic levels.

The decline is being driven by increased new-vehicle supply as the semiconductor shortage eases. The global semiconductor lead time—the time it takes for a semiconductor to reach the end consumer—decreased to 26.3 weeks in September, compared with 27 in August. This is the largest month-over-month decline in several years. Although the decline is notable given the upward trend in lead times in the past few years, 26.3 weeks is still far from the norm. Lead times are expected to remain elevated going into 2023.

Shorter lead times have led to increased vehicle production. Light vehicles produced in Japan, Australia’s largest auto import market, have increased dramatically against 2021 figures. Light vehicles produced in August, the most recent observation, were 22% higher than a year earlier. Still, production has not returned to pre-pandemic health, remaining 14% below 2019 levels.

Nevertheless, improved supplies of new vehicles are easing price pressure in the secondhand market. As the chip shortage eases, carmakers are able to increase production. That ramp-up should ease the “car drought” Australians face for popular makes and models.

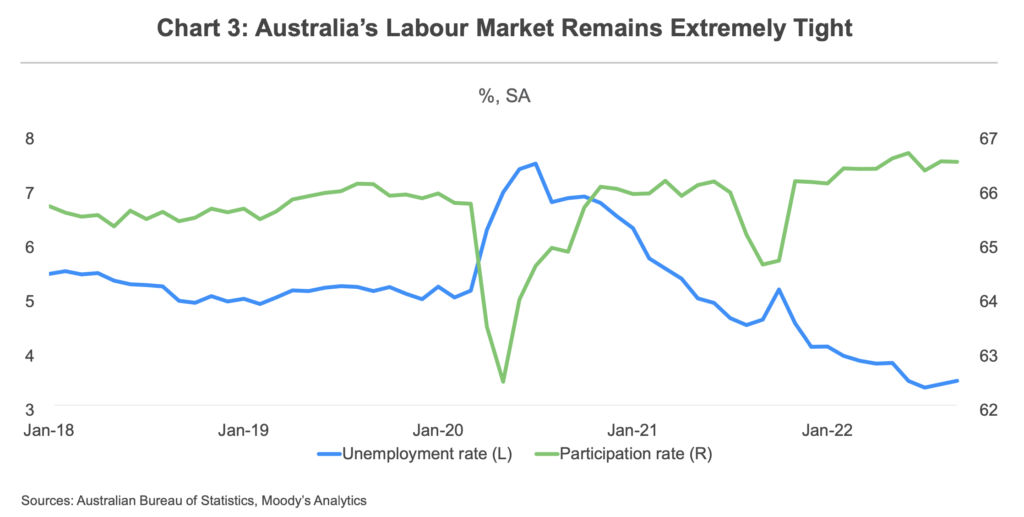

Although demand-side risks have increased in recent months as the Reserve Bank of Australia has lifted the cash rate more aggressively than anticipated, there are no signs yet of a setback in demand for vehicles. Demand is being protected by a surging labour market—the unemployment rate is hovering around its lowest levels since 1974 (see Chart 3). Wage growth has also meaningfully improved. But there are signs of a slowdown. Forward-looking job vacancies have softened in recent months, and this will inevitably flow through to a sustained slowdown in employment growth and, in turn, wage growth.

Weaker demand environment

However, demand for new and used vehicles will cool through 2023. Domestic demand will soften next year as higher borrowing costs alongside elevated inflation erode the purchasing power of households and businesses for discretionary and big-ticket purchases such as vehicles (see Chart 4). The Reserve Bank of Australia has already lifted the cash rate by a cumulative 275 basis points since May, bringing it to 2.85%. The central bank is expected to tighten monetary settings until the cash rate reaches 3.35% in the June quarter of 2023 (see Chart 5). Australia’s GDP growth is expected to decelerate to 1.5% in 2023 from a forecast 3.4% in 2022, with weaker household consumption an important influence.

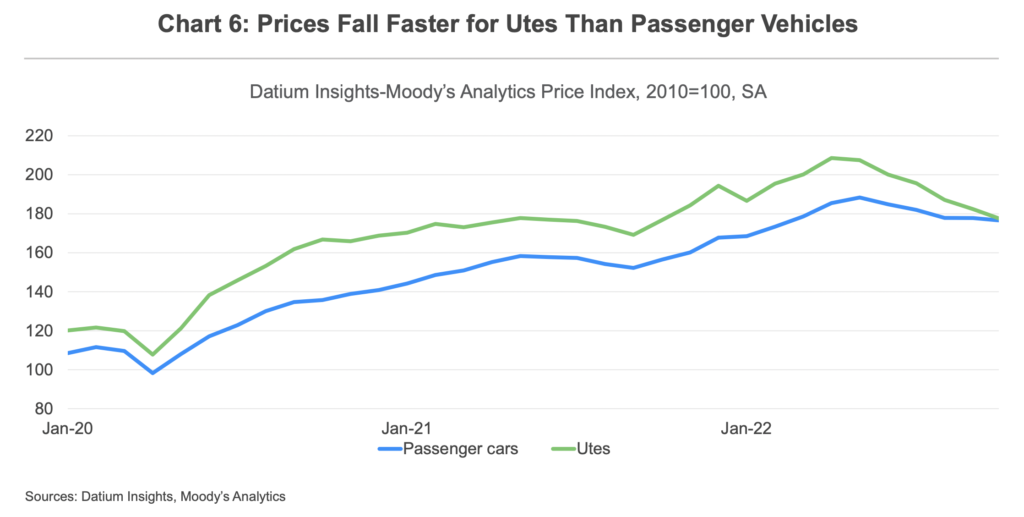

Moody’s Analytics is projecting that used-vehicle prices will continue to fall during the rest of the year as the supply of vehicles increases and sales follow, meeting current demand. Given historically elevated oil and fuel prices, consumers are expected to prefer lighter vehicles to trucks and SUVs; as a result, prices will fall more rapidly in these categories (see Chart 6).

Downside risks dominate

This outlook has risks. If demand wanes because of rising interest rates, used-vehicle prices could fall more steeply. Moreover, rising interest rates on auto-related loans could push certain potential car buyers out of the market or shift their preference to cheaper vehicles. Additionally, any further supply-chain disruption or obstacle to production will cause new-vehicle sales to undershoot the forecast, keeping used-vehicle prices higher for longer.

The housing market is another headwind for households. Rising house prices have been an important sup- port to consumption in recent years via wealth effects. But that support has faded. After a strong runup in prices, particularly in the heated Sydney and Melbourne markets, the housing market has passed its peak and is in the midst of a sustained cooling that will continue into 2024 (see Chart 7).

Near-term outlook

Moody’s Analytics is projecting that the used-vehicle market will correct through 2023 as supply improves and demand conditions soften. However, if consumer demand wanes faster amidst rising interest rates and broader gains in the cost of living, used-vehicle prices could fall more rapidly.