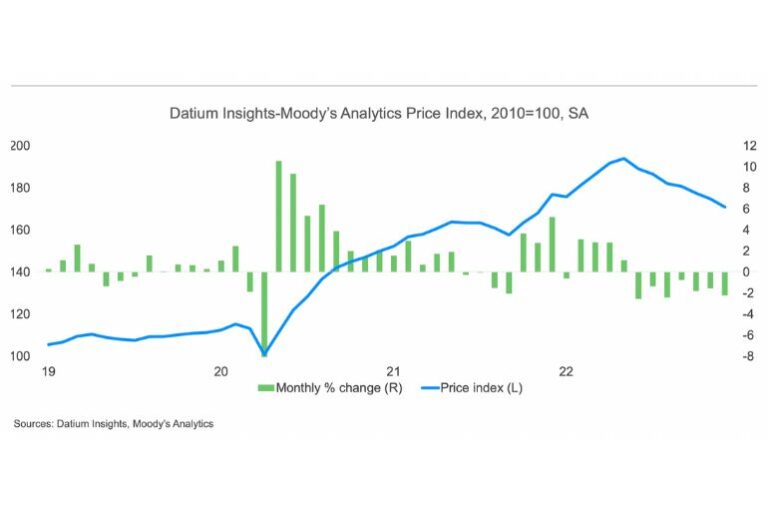

Australian wholesale used-vehicle prices are on a sustained downtrend. The Datium Insights-Moody’s Analytics Used-Vehicle Price Index dropped to 171 in December, down 12% from its peak in May. Increased global production of new vehicles has improved supply and driven the retreat in used-vehicle prices.

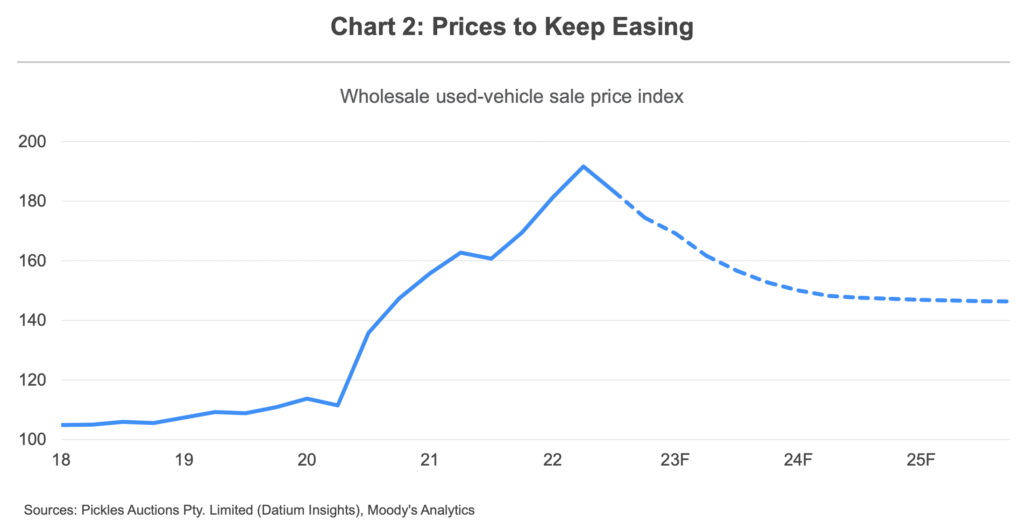

Moody’s Analytics expects used-vehicle prices to continue falling through 2023 as the supply of new vehicles into Australia improves (see Chart 2). Additional downward pressure on vehicle prices will come from weaker domestic demand as the combination of rising borrowing costs and elevated inflation erodes the ability of households and businesses to make big-ticket purchases.

Improved supply

Used-vehicle prices retreated for a seventh straight month in December as supply conditions continued to normalise. Used-vehicle prices notched their first year-on-year decline since May 2020, with a 3.4% contraction. While monthly price declines will proceed through this year, prices are still relatively elevated, remaining 54% above pre-pandemic levels.

The decline is driven by increased new-vehicle supply as the semiconductor shortage eases. Through 2021, a lack of electronic semiconductor chips put auto industry production into low gear for more than a year, limiting global vehicle inventories. Limited inventories for new vehicles sent consumers to the used-vehicle market, driving up prices. Although global vehicle production has not returned to pre-pandemic levels in Europe and Asia, there has been a decent improvement. For instance, vehicle production in Japan was 35% above 2021 levels in October but remained 11% below 2019 output.

Improved global supply has allowed increased volumes of new vehicles into Australia. During the third quarter, Australians imported a total of $7.3 billion worth of motor cars, according to the Australian Bureau of Statistics. This represents a 29% increase compared with the third quarter of 2021.

For 2023, we expect that the supply of new vehicles will continue to increase, further easing pressures in the second-hand market. Recently, Toyota announced it expects to surpass its pre-pandemic production level in 2023.

Weaker demand

Demand for new and used vehicles will weaken over 2023. Australian households are under pressure from rising borrowing costs. Household consumption is still upbeat in Australia thanks to the tight labour market, with the unemployment rate hovering around its lowest level on record. But labour market conditions will soften over the year as tighter monetary policy settings filter through. The Reserve Bank of Australia has already injected 300 basis points’ worth of rate hikes since May 2022. A further 25 basis point hike is expected in February, bringing the cash rate to 3.35%. Households will increasingly feel higher borrowing costs this year as fixed-rate residential mortgages are renegotiated and labour market conditions cool. Additional strain is coming from high prices for non-discretionary items, including food and energy. Inflation is expected to have peaked in the December quarter of 2022 but will gradually cool over this year and not return to the Reserve Bank of Australia’s target range until 2024.

Australia’s GDP growth is forecast to cool to 1.2% in 2023 from an estimated 3.5% in 2022, with weaker household consumption an important influence.

Near term outlook

Moody’s Analytics projects that used-vehicle prices will continue to fall through 2023 as the supply of vehicles increases and demand slows. Prices are expected to fall by slightly more than 10% over the year. Still, manufacturers will remain hesitant to oversupply the market given the considerable global economic headwinds. This will keep used-vehicle prices well above pre-pandemic levels, with stabilisation in prices occurring in 2024.

However, if supply returns faster than expected and consumer demand wanes significantly amidst rising interest rates and broader gains in the cost of living, used vehicle prices have room to fall more rapidly than the current baseline outlook.