Newton’s Third Law says that for every action in nature there’s an equal and opposite reaction. There weren’t any used cars when Issac Newtown first presented his three laws of motion, though the third one is certainly relevant to what’s happening in the automotive market today.

The first action is record new car sales. The reaction is record used car auction volumes.

Manheim is reporting that auction sales volume has increased by 40% this year with an 85% spike in April. The increase in supply is being driven by a strong inflow of ex-fleet, government, and corporate vehicles through the auction lanes.

Another well understood theory is relationship between supply and demand. When supply increases, prices normally fall.

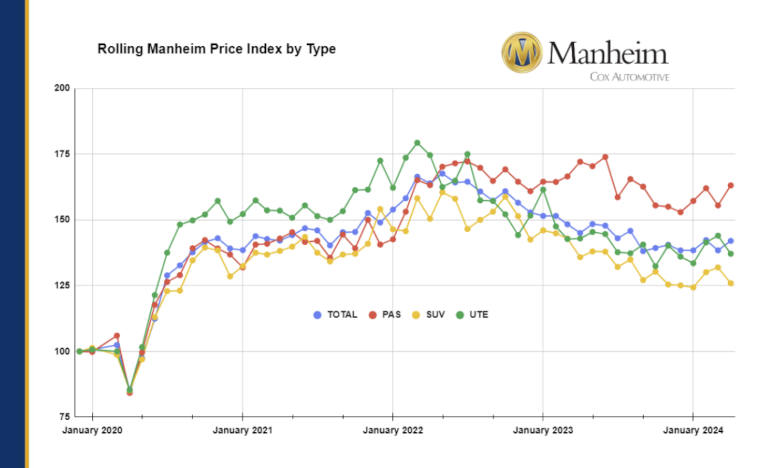

The used car market is yet to reach peak supply based on the prices which remain strong across all segments with the traditional passenger vehicles rising to the top despite their lack of new car sales.

The Manheim Price Index ended April at 142, denoting an average 42% wholesale price increase per vehicle since the baseline of December 2019 including inflation. This is an increase of 3.0% since the start of 2024.

Average auction sales prices are still more than 15% lower now than at the market’s peak of 167.1 in mid-2022 however, when vehicle shortages were driving wholesale prices to all-time highs.

Where is the stock coming from?

Major sources of vehicles sold across Manheim physical and digital public auctions this year are fleet management companies, government and private sector fleets, and dealerships on-selling trade-ins.

Manheim is also expanding the scope and scale of its closed, dealer-only auctions which sell low-kilometre ex-company vehicles. All told we work with around half of Australia’s car brands and have recently signed new partners including Chery, Australia’s fastest growing automotive OEM.

In terms of segment make-up, SUVs had a 34.5% share of wholesale volumes to the end of April YTD, traditional passenger vehicles (sedans, hatchbacks, wagons, people-movers, two-doors) owned 33.1% share, and light commercials 32.3%.

EVs and PHEVs had just 0.1% wholesale volume market share, unsurprising given the vast majority of EVs sold so far remain with their first owner – be they fleet or private. This figure will start to change quickly from 2025 onwards, and Manheim is well-positioned when it comes to EV readiness.

The overall top-selling used cars in Manheim auction lanes so far in 2024 are:

- Ford Ranger (+19.9%)

- Isuzu D-Max (+79.5%)

- Toyota Camry (+49.3%)

- Toyota Corolla (+74.4%)

- Mitsubishi Triton (+48.8%)

Each one of the cars listed above have seen an increase in new deliveries in 2024.

What’s happening with used car prices?

While overall prices are 42% higher than December 2019 across the wider Manheim wholesale market, there are significant discrepancies in sale prices depending on vehicle type and vehicle age, as the table below shows.

Simply put, passenger vehicles are holding inflated prices longer than SUVs and light commercials, down in large part to a lack of supply driven by their declining share of the new vehicle market – which invariably knocks onto the second-hand market.

So too are older vehicles retaining higher Price Indexes than younger models, reflective of consumer demand for older and more affordable transport considering current household budget pressures such as higher interest rates and persistent inflation.

The table below shows the average wholesale price increases between Dec 2019 and April 2024, by vehicle type and age.

“We have seen an uptick in volume at Manheim wholesale auctions in 2024, with increasing foot traffic to our east coast physical auctions and strong performances from our OEM and clearance vehicles in particular,” said Manheim Australia managing director Murray Naismith.

“While we have made some positive strides this year with good results and new initiatives, we continue to focus on excellence across all aspects of our business in our bid to maximise vendor returns and create a fun, safe and friendly environment for our valued customers.”