Manheim Australia maintained healthy sales momentum during October, with monthly wholesale volume up 17% over October 2023, and 9.3% over the preceding month.

October volume was in fact the second highest for a single month in the past four years behind July 2024, while year-to-date (YTD) volume has now eclipsed the full-year result for 2023 – with two months to spare.

YTD Manheim volume is up 37.1% over the same period in 2023.

Manheim saw particularly good October wholesale volume sold on behalf of Dealers, up 33% month-on-month (MoM). Much of this is being driven in part by a substantial year-on-year (YoY) uptick in private buyers attending the weekly auctions in-person or online.

October 2024 was moreover the second-best month this year for vehicles sold on behalf of Governments, Financiers and Manufacturers respectively.

For the full year, 2024 is on track to be the biggest year for volume since 2020. Volume has not yet returned to the same volume observed prior to the pandemic, but there has been a steady uptick since the start of 2023 and it’s getting closer to pre-COVID levels.

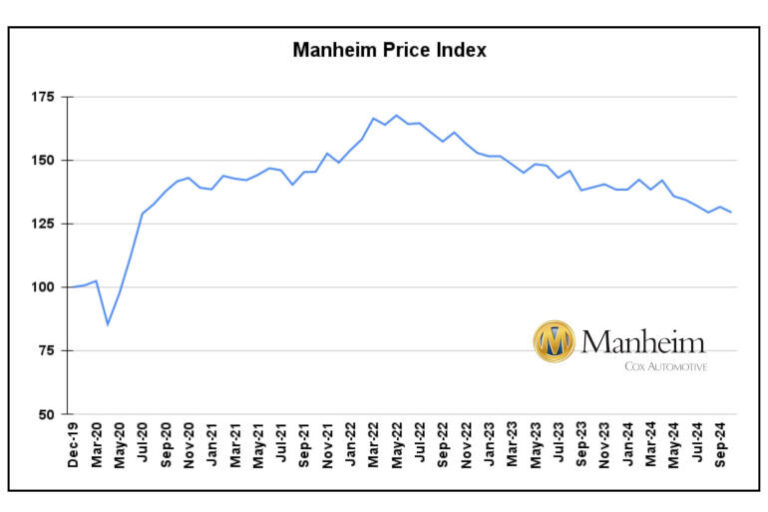

At the same time, wholesale prices continued their long-term decline as measured on the Manheim Price Index, which is down 7.1% year-on-year (YoY). Volume-weighted wholesale prices are now 22.9% lower than at the market’s COVID-induced peak, in May 2022, and back at mid-2020 levels.

That being said, the current Index of 129.4 still denotes an average per-unit price increase of 29.4% since December 2019, the baseline period. In other words, the market is stabilising post the outlier COVID period, but expected selling prices remain relatively robust.

As has become familiar, prices are proportionately still more elevated for Passenger Cars (up 39% since December 2019) than SUVs (up 17.2%) and Utes (up 28.4%) due to constricted supply. The most inflated of all vehicle types are 8–10-year-old sedans and hatchbacks, up 51.3% over pre-2020 prices.

Passenger cars are also quicker to sell in the lanes or online (21 days on average) than SUVs and Utes.

Three more interesting points worth noting:

- The single fastest-growing vehicles this year are 2-4-year-old Toyota RAV4s, sales of which are up 742.3% YoY due to increased fleet turnover.

- While EV sales remain a small component of Manheim sales, they’re up 71% over the full-year of 2023 total, and account for 6% of ex-manufacturer cars offered at dealer-only auctions (average age under 2 years). A sign of what’s to come, with more EV-only auctions planned.

- Fleet Lease volume hit an all-time high in Q3 of 2024, and the dealer-only SG Fleet auction held in mid-November achieved a 93% clearance rate from 150 cars. These figures will be part of the November results in due course.

Top 5 selling cars for October 2024

- Ford Ranger – Up 43.2% MoM

- Toyota Corolla – Up 16.9%

- Toyota Camry – Up 34.4%

- Mitsubishi Triton – Up 83.8%

- Holden Colorado – Up 18.2%

Top 5 selling cars January to October 2024

- Ford Ranger – Up 40.5% YoY

- Toyota Corolla – Up 70.1%

- Toyota Camry – Up 50.1%

- Toyota HiLux – Up 54%

- Isuzu D-Max – Up 57.9%