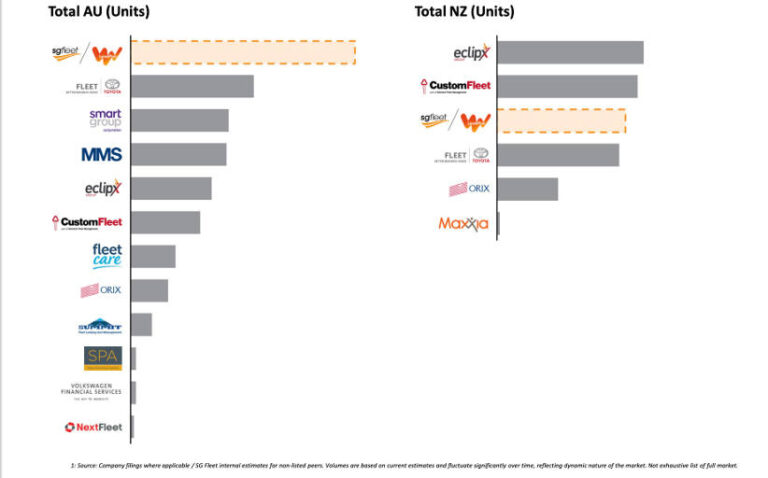

The recent announcement that SG Fleet will buy the Australian and New Zealand arm of global fleet leasing company Leaseplan has provided some data on the size of local fleet management, leasing and novated providers. Obviously SG Fleet will be the largest once combined with Leaseplan; but who is second?

In the documents supplied by SG Fleet to support the purchase decision they included a graph that placed Toyota Fleet Management as second largest in Australia using their internal estimates.

Fleet Auto News knows from the annual reports of other listed companies that McMillan Shakespeare has 110,000 (71,800 novated and 39,600 corporate) and Smart Group has 90,000 (24,900 corporate and 66,700 novated). Eclipx reported 95,000 vehicles which approximately 25,000 are in New Zealand.

FAN estimates that Summit Fleet Lease have 40,000, ORIX have 35,000 and Fleetcare 30,000 vehicles all split between novated leases, fully maintained operating leases and fleet managed.

On the Custom Fleet website they claim 100,000 vehicles under management in Australia and New Zealand. In the annual reports of parent company Element Fleet Management they estimate 15% market share.

The top 10 leasing companies seem obvious though without any transparent industry reporting it’s hard to know the actual ranking of each fleet management organisation outside of the listed entities.

Here’s the Fleet Auto News 2021 estimate of the top 10 (based on fleet size) novated leasing and fleet management organisations before the SG Fleet announcement;

- SG Fleet

- Toyota Fleet Management

- McMillan Shakespeare

- Leaseplan

- Custom Fleet

- Eclipx

- Smartgroup

- Summit Fleet Leasing

- ORIX

- Fleetcare

[news_list display=”category” format=”” category=”20″ show_more=”on”]