– By Caroline Falls –

In some good news for fleets ready to dispose of vehicles, Australian used-vehicle prices rebounded strongly in May. Still, they have more gains to make before reaching pre-COVID levels.

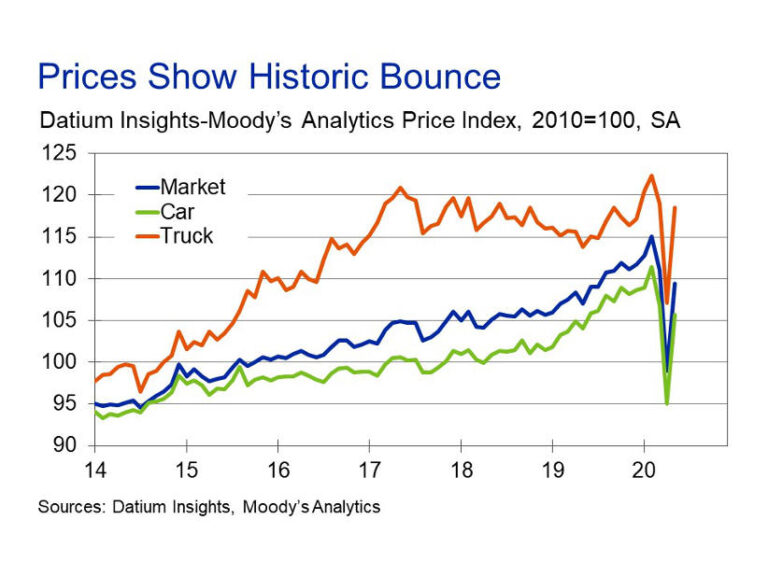

A new report by business intelligence group Moody’s Analytics showed used-vehicle prices rose 10.6 percent in May from April, following a drop of 14 percent in April from March. Moody’s partnered with Datium Insights, a unit of Pickles Auctions, to do the report.

“The auto industry was acutely impacted by the lockdowns imposed through plummeting demand for autos and transportation in general,” said the report’s author Michael Brisson in his introduction, adding, “The May comeback is a welcome sign that the economic reopening is taking hold.”

The price increase in May was better for cars than it was for trucks or utes. Car prices rose 11.2 percent; truck/ute prices rose 10.6 percent. The varying rebounds reflects a deeper fall for cars earlier in the pandemic, the report said.

“Supply constraints, the substitution effect, low fuel costs, and a decline in public transportation have all helped prices bounce back from April lows.”

Declines in new vehicles sales in the past 24 months, and an expected continuation of that trend, is likely to keep supply of used-vehicles coming to market tight. This will provide support for used vehicle prices.

“Pretty sure used car prices will be buoyant for least the next quarter and will be also driven by lower used vehicle volumes,” said Brendon Green, general manager at Pickles Auctions, commenting on the report.

“Supply of all new and used-vehicles is going to remain tight for next six months at least,” said David Lye, founder of PriceMyCar.com.au, in a comment on LinkedIn. “New cars are certainly drying up. Isuzu, Ford, Toyota for example are all struggling to supply. Less cars coming in will have a flow-on effect to used cars.”

Green said the initiative of Datium and Moody’s to introduce a used-vehicle index had been positively received by fleet and finance customers.

Other drivers of improved used-vehicle prices include low-fuel costs and a plunge in public transport patronage. Low fuel prices damp demand for newer more fuel-efficient vehicles.Fuel prices are forecast to remain low in the foreseeable future as global energy demand remains depressed, said the report.

Concern amid the pandemic about health and safety of travelling on public transport is expected to persist until a vaccine is available. That concern underlines the move to favour driving, and even a trend to buy a second-hand cheap vehicle.

To be sure, Moody’s analytics doesn’t expect any significant price increase in the used-car market from here on.

“Continued economic stress will restrict price growth over the near to medium term despite the strong start to reopening,” the report concluded.

To see the full report click on the link here

— Caroline Falls is a freelance journalist, writing for Australian and international business publications. She can be contacted at carolinefalls@gmail.com